Like other successful organizations, hospitals and healthcare providers focus their costly resources where they’ll glean the most benefit. But the tipping-point between cost & benefit is shifting as consumers pay more out-of-pocket for their medical care. Providers struggle to apply the appropriate resources to bill & collect lots of small patient co-pays, deductibles, and co-insurance payments from individual healthcare consumers.

Revenue from patients is an increasingly greater part of your income but the large number of small transactions is disproportionately impacting your expenses.

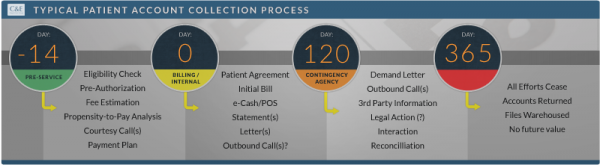

The traditional payment collection model typically includes these four phases:

1) Date of Service to Day 30 – Billing process and settlement occurs for insurance portion

2) Days 30-120 – Patient bills & statements are sent and initial collection efforts are made

3) Day 120 – Unpaid patient accounts are placed with contingency agencies

4) Day 365 – Patient accounts still unpaid are recalled or linger with contingency agencies

This traditional model was adequate when insurance covered 80+ percent of healthcare services and EDI handled most of the transactions between providers & payers. Overhead costs absorbed by healthcare providers to settle accounts with insurers was easily justified by the revenue gained.

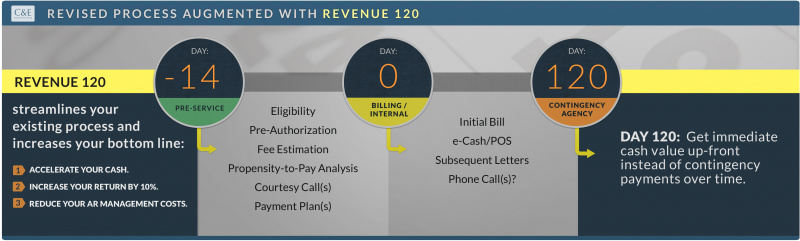

REVENUE 120 maximizes your patient revenue while avoiding the expense of servicing your low-balance patient accounts. Instead of you spending your time & money to recover small, random amounts over indefinite periods of time, we’ll pay you up-front for your patient responsibility and self-pay accounts.

Get more cash up-front than you are now getting in over a year’s time

Our goal is to pay you at least 110% of your current 12-to-18 month performance up-front. Contact us today for an assessment of your operation. We’ll provide a no-cost, no-obligation customized side-by-side comparison of your current results to REVENUE 120.